A business credit card with a low interest rate can be a lifeline for small businesses operating on a tight budget, as well as companies operating in industries where slow payments can cause cash flow problems.

Companies that have debt to consolidate can also benefit from these cards if they choose one that offers a starting APR for both purchases and debt transferred from other cards and loans.

Add to that the fact that some 0% APR business cards offer spending rewards and it’s easy to see why they’re so popular. However, you’ll want to read the fine print to understand the APR introductory offer and other credit card terms and conditions.

Best business credit cards with balance transfer for 2022

But what cards should you consider if you hope to not pay interest for a while? A number of business credit cards offer 0 percent APR for a limited time, including the following options:

US Bank Visa Business Triple Cash Rewards Card: Best for bonuses and cash back.

pros: This US bank card gives cardholders an initial rate of 0% APR on purchases and balance transfers for 15 billing cycles (then ranging from 16.99% to 25.99% APR) and the opportunity to earn a $500 bonus , spending $4,500 within 150 days of opening. map. Customers also receive 3% cash back on qualifying purchases at gas and electric vehicle charging stations, stationery stores, cell service providers and restaurants, as well as 1% on other expenses.

Minuses: If an extended period with zero interest is your priority, the US Bank Business Platinum card provides more flexibility.

Why do we like itA: The US Bank Visa Business Triple Cash Rewards card offers an exclusive reward and APR initial offer that covers both purchases and balance transfers for more than one year.

bottom line: The US Bank Visa Triple Cash Rewards business card is a great choice for business owners who want to save money on interest while getting rewarded for their spending. The icing on the cake is the absence of an annual fee.

US Bank Business Platinum Card: Best for long yearly introductory period

pros: The US Bank Business Platinum card comes with a 0 percent initial annual interest rate on purchases and balance transfers for 18 billing cycles at account opening (then that’s between 14.99 percent and 23.99 percent variable annual interest rate). This means you will have over a year to pay off the transferred debt without interest, allowing your business to save money and manage debt over time. There is also no annual fee for the card.

MinusesA: Unlike other business cards, including other US bank offerings, the Business Platinum card does not offer a cash back or signup bonus.

Why do we like itA: If you have significant debt that you want to transfer, the US Bank Business Platinum Card can be a great option. With 18 months of zero annual interest on purchases and balance transfers, this gives you over a year before you have to pay any interest. If you have a large amount of debt, you may be interested in stretching the payback period as long as possible.

bottom line: This card is a great option if you are looking for a long term with zero annual interest rate to pay off your current debts.

Wells Fargo Business Platinum Credit Card: Cash Back Reward

pros: The Wells Fargo Business Platinum Credit Card includes an initial 0 percent APR for nine months on purchases and balance transfers (then variable APR between Wells Fargo Prime plus 7.99% and Wells Fargo Prime plus 17.99%), and allows you earn 1.5 percent cashback for every dollar deducted.

Instead, you can also earn points: 1 point for every dollar spent and 1,000 reward points for every billing cycle when you spend at least $1,000 on qualifying purchases. There is also a $300 cash bonus or 30,000 points if you spend at least $3,000 on purchases within three months of opening an account.

MinusesA: The 0 percent start-up period is significantly shorter than the US Bank Business Platinum card. The refund on this card is also much less competitive than some other companies.

Why do we like it: The Wells Fargo Business Platinum Credit Card has no annual fee and offers a solid reward rate on all purchases. Although it has a shorter initial 0% APR period, nine months may be enough for many business owners.

bottom lineA: The Wells Fargo option is solid if you need some time to pay off your existing balances and want to cash in on the process.

How do business balance transfers work?

A household balance transfer works in the same way as a personal transfer. Once your new account is set up, you can initiate the transfer either online or by sending a paper check. Make sure the transfer amount does not exceed your new line of credit and take the time to account for any balance transfer fees you may be asked to pay.

After the transfer process, the old account will be redeemed if you had enough funds to cover the full balance. If there is still a balance left in the old account, pay it off as soon as possible to minimize interest costs.

The transfer amount will appear in your new account balance and you can start making payments against that principal immediately.

Does the balance rollover affect my company’s creditworthiness?

While transferring the balance will not directly lower your credit score, it can affect your credit profile. When you open a new account, your credit age (the amount of time your accounts have been open) decreases. This can have a negative impact on your credit score, as a higher account age positively impacts your report.

On the other hand, if transferring the balance allows you to pay off your debt faster, your credit utilization ratio (how much credit you have versus how much you use) will improve.

Also note that applying for a new loan will automatically improve your loan utilization rate. This is because you now have more credit available but the same amount of debt. As your debt decreases, your credit may see even more improvement.

How to choose the right credit card for business?

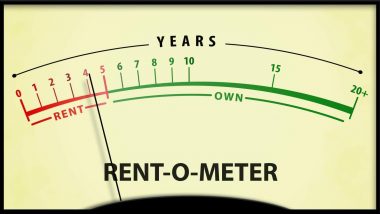

If finding a business credit card with a 0 percent annual interest rate is your top priority, you should start there and narrow down the cards based on the other benefits they offer. For example, you will find business balance transfer cards that also offer spending rewards, which can be incredibly attractive. This is especially true for business credit cards, which offer generous welcome offers of $500 or more within a few months of signing up.

However, you’ll also want to compare factors such as the length of the initial APR period, the annual fee, the cashback fee, the balance transfer fee, and your APR after the initial rate ends. By examining a number of options, you can get the best value for where you are now.

bottom line

The best business balance transfer cards allow you to transfer debt and save money on interest, but they also have other benefits. Be sure to compare all the best business credit cards to find the right one, and remember that a wider range of small business cards also offer 0 percent APR on purchases only.

Editorial disclaimer

The editorial content on this page is based solely on the objective judgment of our contributors and is not based on advertising. It was not provided or ordered by credit card issuers. However, we may receive compensation when you click on links to our partners’ products.