To fully appreciate the modern convenience of credit cards, simply swipe your card at a payment terminal, pause while it’s being processed, and consider what it has replaced.

Before the advent of plastic, money as a medium of exchange for goods and services was onerous, if not downright dangerous. Starting from 9000 B.C. From cattle and camels, the currency took on truly strange forms, from cowrie shells, bronze and copper cowrie shell imitations, gold and silver nuggets, to Chinese deerskin banknotes and Indian beads strung on wampum threads.

From the beginning, credit cards provided significant advantages over all forms of money: they were pocketable, easily portable, relatively secure, and had no inherent value in and of themselves. What’s more, real credit cards allow you to buy time to pay your bill, usually with a small fee.

The invention of credit cards

According to historian Jonathan Kenoyer, the concept of using a useless tool to represent banking transactions dates back to 5,000 years ago, when ancient Mesopotamians used clay tablets to trade with the Harappan civilization. While cumbersome, the clay slab bearing the seals of both civilizations certainly outnumbered the tons of copper each had to melt to produce the era’s coins.

However, the credit card prototype has changed since the beginning of human history:

- Circa 1800s: Merchants used credit coins and credit plates to provide credit to local farmers and ranchers until they profited from their crops.

- 1946: Banker John Biggins launched payment cards with the Charg-It card, which was used within a two block radius of his bank in New York. Customers’ purchases were forwarded to his bank, and merchants were reimbursed later in what was called a “closed-loop system.”

- 1950: The Diners Club Card was first introduced when Frank McNamara forgot his wallet and couldn’t pay for a business dinner. He came up with the idea of a small cardboard card that members could use as a payment card and pay their bills in full each month.

- 1958: American Express released its first paperboard credit card, followed shortly by the first plastic credit card in 1959.

The invention of bank cards and revolving credit

The big banks will soon be launching their own consumer cards, but with a nice twist. Instead of users having to pay their bill in full every month, bank cards would truly become credit cards, offering revolving credit that allowed cardholders to carry their monthly balance forward for a nominal funding fee.

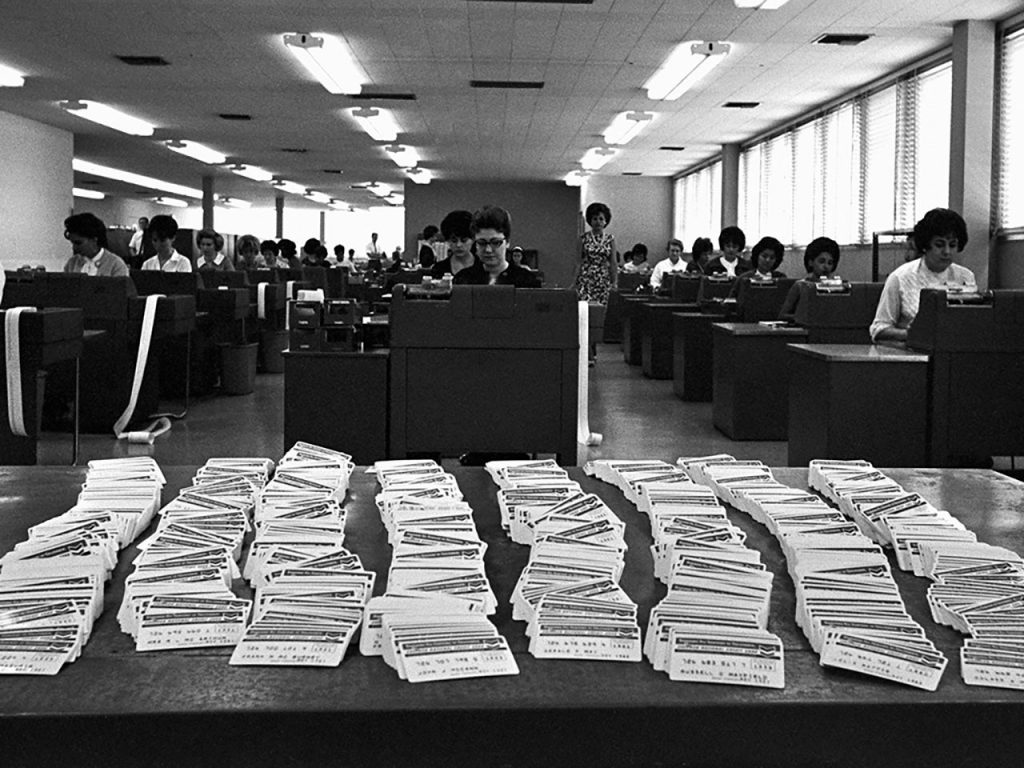

Bank of America first entered the market in 1958, mailing unwanted credit cards to select California markets. In 1966, BankAmericard went national and became the nation’s first licensed general purpose credit card. Ten years later, it will be renamed Visa in recognition of its growing international presence.

Also in 1966, a group of California banks formed the Interbank Card Association (ITC), which soon issued the country’s second-largest banking card, Mastercard. Today’s Mastercard competes directly with its counterpart, Visa, both of which are run by boards made up primarily of current and former high-level corporate executives.

Unlike their non-bank competitors, bank card associations operate in an “open cycle” system that requires interbank cooperation as well as fund transfers. While banks initially had to choose between the Visa and Mastercard associations, changes to the association’s charter have since allowed them to join both associations and issue both types of cards to their customers.

Regulation and litigation

As the popularity of credit cards grew in the 1970s, so did legislation to deal with consumer complaints about this rapidly growing industry. Regulatory adjustments include:

- The Fair Credit Reporting Act of 1970 restricted the collection and use of credit report data.

- The Unwanted Credit Cards Act of 1970 prohibited issuers from sending active cards to customers who did not request them.

- The Fair Credit Billing Act of 1974 amended the Truth in Lending Act to curb abusive billing practices and enable consumers to challenge billing errors.

- Also in 1974, the Equal Credit Opportunity Act was passed to prevent lenders from discriminating against any applicant based on gender, race, marital status, national origin, or religion.

- The Fair Debt Collection Practices Act of 1977 amended the Consumer Credit Protection Act to prohibit predatory debt collection practices and redesign the debtor’s bill of rights.

- The Credit Card Accountability, Liability, and Disclosure (CARD) Act of 2009 added consumer protection in the form of limits on credit card interest rates, fees, and charges charged to cardholder accounts.

The debut of Sears Corporation’s Discover card in the 1986 Super Bowl led to a major litigation when Discover filed an antitrust suit against Mastercard and Visa for illegally preventing their association banks from issuing Discover cards. The six-year legal battle ended in 2004 when the US Supreme Court refused to hear the defendants’ appeal, effectively allowing banks and other card issuers to issue different brands of cards.

The passage of the Credit Card Act brought greater transparency to consumers and eliminated or reduced a number of card issuer violations, including interest rate hikes, late fees, and over limit charges in the midst of the Great Recession.

Development of credit card technology

Since the early 1960s, when IBM introduced magnetic stripe (or “magstripe”) credit card verification, technological innovations have occasionally taken center stage in the cashless payment game.

But some technological changes have become standards. While the vast majority of credit cards still have the 1960s magnetic stripe, cards with a microchip visible on the front of the card are now standard. Here’s how credit card technology has changed over the years:

- 1980s: The first credit card with a smart chip was created, which became popular throughout Europe and even appeared in the 1995 film French Kiss.

- 1996: Europay, Mastercard and Visa have jointly published smart chip standard specifications called EMV chips. These chip cards have the advantage of using encrypted communication rather than relying on an unencrypted magnetic strip that is easy to read and copy onto a counterfeit card, otherwise known as cloning.

- 2005: For the first time, Radio Frequency Identification (RFID) was tested using a Samsung NFC smartphone in some shops and retail stores in Caen, France.

- 2010: Barclay and Orange have teamed up to launch a contactless payment card. This technology allows consumers to complete a transaction by swiping a card at a compatible terminal and provides encryption similar to EMV smart chips.

- 2014: Apple is releasing Apple Pay, allowing cardholders to download their information to their smartphones and leave their cards at home.

- 2015: Google is launching its own Android Pay contactless phone wallet system, now called Google Pay.

- 2015: The retail payment industry has undergone a shift in liability, whereby the costs of fraudulent transactions are borne by the retailer if they choose not to upgrade their terminals to accept new cards.

- 2021: A change in the responsibility of gasoline sellers has been introduced.

The Future of Credit Cards

What will credit cards look like in 25, 50 or 100 years? It is clear that we will not always need a physical artifact to represent our financial accounts. In fact, many issuers now offer on-demand virtual credit cards if you need an extra layer of security while shopping.

After all, we don’t carry around cards that represent all of our loans and investments. The near future is likely to see a wider adoption of payments using smartphones and other contactless devices, even though no standard has been developed from all the competing technologies available.

These devices work well until you run into a vendor terminal that is not RFID compliant. In 2021, there are still many retailers that do not use RFID-compatible terminals and a few popular credit cards that are not compatible with the most popular mobile payment systems.

There are also tens of millions of consumers who would rather just pull out their favorite card than try to guess if a particular retailer’s terminal will be compatible with their payment system. As is the case with many other technologies, the emergence of a dominant standard will seem obvious to everyone in retrospect.

In addition to RF-enabled cards, phones and wearables, the next step will be payments using biometric authentication such as fingerprints, iris scanning and facial recognition.

However, problems still remain. While you can easily get a new account number if your credit card details are stolen, it’s not that easy with biometrics. You won’t be able to change your fingerprints or the pattern of blood vessels in your eyes if someone steals that data.

Judging by the changes we are seeing around us today, from rapidly evolving online payment and mobile payment technologies to home appliances that track and digitally organize their own content, card payments will increasingly be integrated into our lives in new and creative ways. . In the same way that we shop using internet-enabled devices from companies like Amazon and Google, perhaps we will shop using our cars, refrigerators, or even our toasters.

But what continues to be pretty much the same is your credit card account, no matter what physical device, if any, is connected to it. Credit card accounts continue to be the most secure and convenient payment method. These accounts also offer us unmatched benefits, many of which have the ability to earn rewards for spending.

And, of course, credit card users can still fund their purchases over time or avoid interest payments by paying their balances in full. Laws relating to these accounts undergo legal reform about once every generation, such as the Fair Credit Billing Act of 1974 and the CARD Act of 2009. Thus, it is likely that we will see further refinements of these laws in the future.

Ultimately, it is the financial terms of credit card accounts that are the essential and eternal features of our “cards”, whether or not we continue to use any device to access our accounts in the future.

Editorial disclaimer

The editorial content on this page is based solely on the objective judgment of our contributors and is not based on advertising. It was not provided or ordered by credit card issuers. However, we may receive compensation when you click on links to our partners’ products.