The lease versus purchase debate can get extremely heated. For some, renting longer than you need is akin to setting your hard-earned money on fire.

Others see homeownership not as the fulfillment of the American dream, but as a financial prison that restricts your mobility and liquidity and sucks money for interest, repairs, and taxes.

This is where our rent and purchase calculator comes in handy.

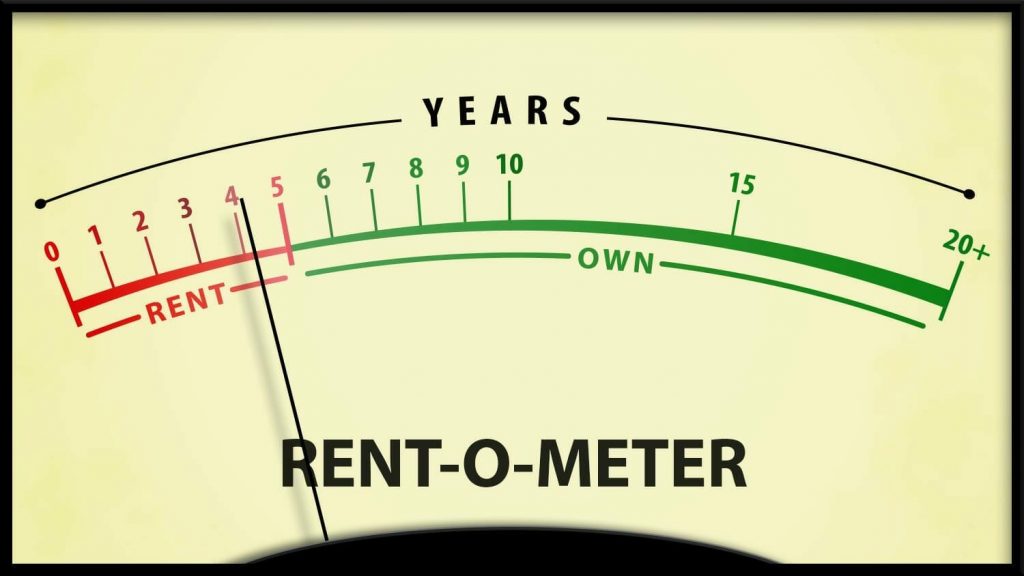

It tells you in the simplest terms how long you need to stay in your home to pay off and how long you need to stay before the purchase becomes a serious money saving decision.

Rental and Purchase Calculator: Our Assumptions

For most figures, we looked at national averages over the past 15 years.

rental market

In terms of rents, we found that the national average is increasing by 3% per year, so we assumed that rents would increase at the same rate in the future.

Real estate value

In terms of year-on-year increase in home values, we found that the national average is 3.5% (according to the Case-Schiller House Price Index). Yes, you can get rich on a house that will skyrocket in value. But the vast majority of US house prices are rising only slightly faster than inflation.

Inflation

For the last 15 years inflation has been low – 2.2% per year. We have used this number to calculate future expenses such as maintaining a house.

Property tax

For property taxes, we have assumed taxes equal to 1.5% of the value of the home, which is the national average.

Mortgage interest, insurance and tax deductions

When calculating “expenses”, we included the interest on the mortgage, but not the principal. For taxes, we included any tax deductions on mortgages that were in excess of the standard deductions. We also assumed that your tax status was “single” (no offense!).

We also accounted for private mortgage insurance. In case you’re unfamiliar, Private Mortgage Insurance (PMI) is a special type of insurance that your mortgage lender requires from you if you make a down payment of less than 20%. It typically costs between $100 and $250 per month, and once you reach 20% of your home’s net worth, you won’t have to pay for it anymore.