Details: The Best Credit Cards for Young People

I’ve compiled some of the best cards across a wide range of scores to help you find something that fits your credit profile.

Let’s take a look at each one, from the highest to the lowest credit requirements.

Chase Freedom Unlimited® Card

Best for rewards and sign up bonus

Pursuit of Unlimited Freedom® the card offers quite a large signup bonus. Earn extra 1.5% on all purchases (up to $20,000 spent in the first year). Add in a healthy starting annual interest rate and a strong fee structure and you have one of the best credit cards for young people with good credit.

That I love

- Huge Welcome Bonus: Earn Extra 1.5% on all purchases (up to $20,000 spent in the first year)

- Excellent money back rates.

- 0% initial APR on purchases within 15 months And 0% per annum for balance transfer within 15 months (fee applies for balance transfer)

- No annual fee.

The Chase Freedom Unlimited® card is one of the best cashback cards.

First, you get the Chase Ultimate Reward, which can be a very valuable journey reward. In addition, you will earn extra 1.5% on all purchases (up to $20,000 spent in the first year).

Oh and you will pay 0% initial APR on purchases within 15 months And 0% per annum for balance transfer within 15 months.

In terms of regular credit card rewards, this card offers the following:

- 3% on restaurant meals, including takeaway and related delivery services.

- 3% off purchases at the pharmacy.

- 1.5% for everything else.

Rewards do not expire; You get all of this without an annual fee. If you choose to use this card while traveling, please be aware that it will incur international transaction fees.

Read our full Chase Freedom Unlimited® review.

Chase Freedom Flex℠ Card

Best money back

Best money back

Chase Freedom Flex℠ offers new users an excellent $200 bonus after you spend $500 on purchases within the first 3 months of opening an account.. In addition, they earn 5% on quarterly changing categories and great rates in some other categories. Rewards never expire and users receive a long 0% introductory annual interest rate.

That I love

- Welcome Bonus: $200 bonus after you spend $500 on purchases within the first 3 months of opening an account..

- 0% initial APR on purchases within 15 months And 0% per annum for balance transfer within 15 months (fee applies for balance transfer)

- 5% cashback on combined purchases up to $1,500 quarterly.

- 3% cashback on purchases at pharmacies and restaurants, including take-out and delivery services, and 1% unlimited cashback on all other purchases.

The Chase Freedom Flex℠ card is another great bonus card from Chase.

This card offers a 5% cash back on purchases up to $1,500 each quarter in rotating categories. For example, it can offer 5% off Amazon purchases and streaming services up to $1,500 for 3 months.

At the same time, you can earn 3% for food, takeaway, delivery, and pharmacy purchases, as well as 1% cashback for everything else.

Read our full Chase Freedom Flex℠ review.

Card information has been compiled by MoneyUnder30 to help consumers better compare cards. The financial institution did not provide or approve the card details.

Capital One Platinum credit card

Best with no annual fee

Great for those with average credit can get a good unsecured credit card with Capital One Platinum credit card.

That I love

- Unsecured card for medium credit.

- Automatic check of the credit line six months after opening.

- Low fees.

Need a credit card but don’t want a secured card? The Capital One Platinum card might be a good choice.

This map is relatively simple. There are no annual or foreign transaction fees and you can qualify for an average loan.

In addition, Capital One automatically considers extending the credit line six months after opening if you use the card responsibly.

The downside is that this card does not provide any rewards. But it can be a good starting point if you are still working on your score.

Read our full review of the Capital One Platinum card.

Capital One Quicksilver Cash Rewards Student Credit Card

Best for Students

Capital One QuickSilver Cash Rewards Student Credit Card combines the possibilities of lending and cash back. No annual, overseas transactions or hidden fees and you will also receive $50 if you spend $100 on purchases within 3 months of opening an account..

That I love

- No overseas transactions, annual or hidden fees.

- Unlimited 1.5% cashback on all purchases.

- Welcome Bonus: $50 if you spend $100 on purchases within 3 months of opening an account.

College is a great time to start earning loans. The Capital One Quicksilver Student Cash Rewards card is a great choice for this.

This card pays out unlimited cashback of 1.5% on every purchase, and points don’t expire. The card also charges almost no commission.

In addition, you can earn $50 if you spend $100 on purchases within 3 months of opening an account..

All in all, this is a no-frills student card for those who want to get a loan and make some money at the same time.

Read our full review of the Capital One Quicksilver Student Cash Rewards card.

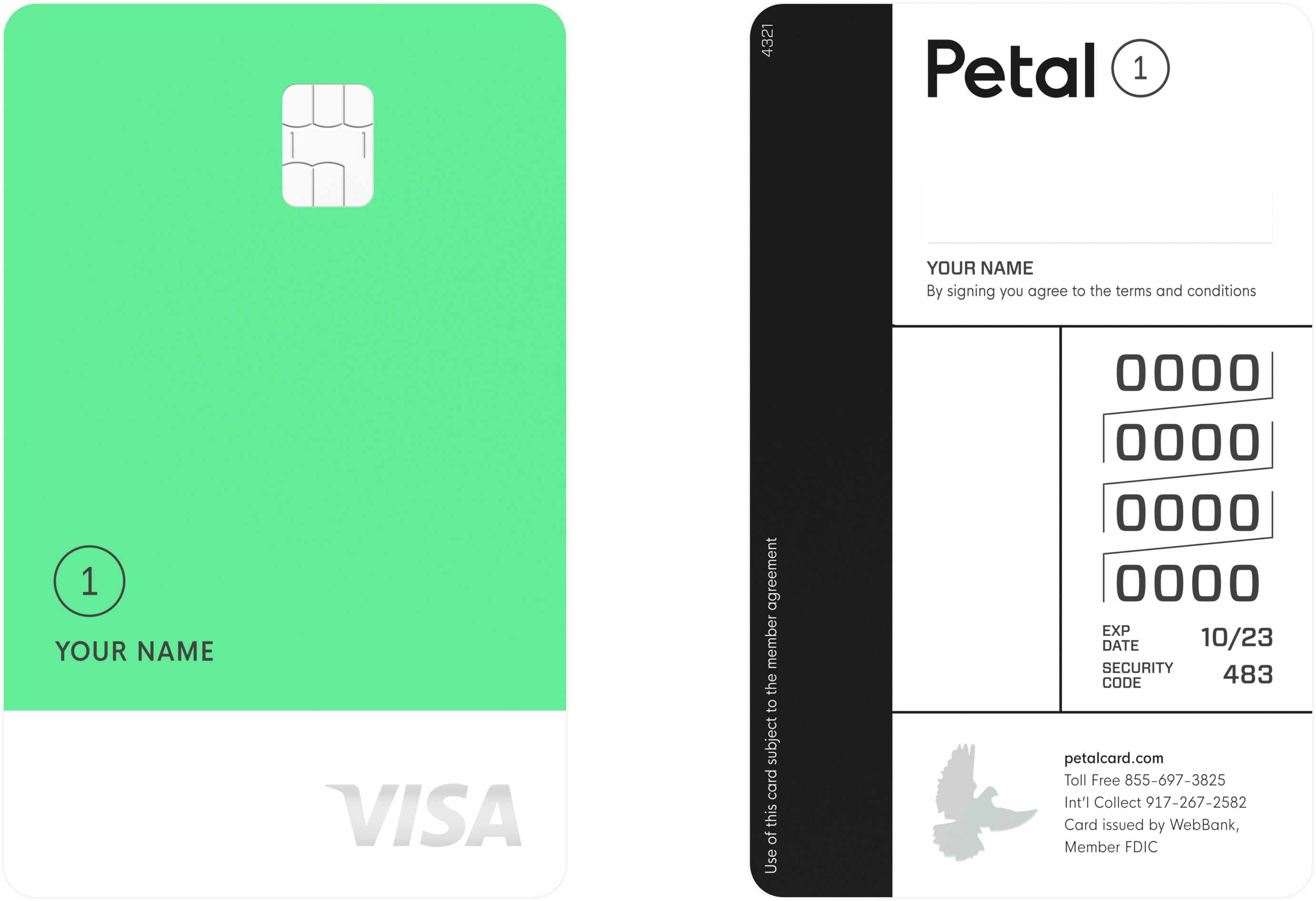

Visa® Petal® 1 Credit Card “No Annual Fee”

Best for people with low credit

Visa® Petal® 1 Credit Card “No Annual Fee” is an unsecured card with no fees and the ability to earn significant cash back on purchases from certain brands. Responsible use can give you a credit limit of up to $5,000. These factors make it a good starting card for building credit.

That I love

- Cashback from 2 to 10% in some stores.

- No annual, over-limit or overseas transaction fees.

- No credit history required.

The Visa® Petal® 1 No Annual Fee Credit Card is one of the best first credit cards for young people. This can also work well if you are rebuilding your credit.

You don’t need any credit history to qualify. WebBank, the issuer, does not charge annual foreign transaction fees or over-the-limit fees to make this card as affordable as possible. And the card is unsecured – no collateral is needed.

In addition, users can earn 2-10% cashback at select stores. You can check the app to see which brands near you are offering rewards.

Credit limits up to $5,000 are available. Petal determines your limit, but with Leap you can get a line of credit extension within 6 months by making the appropriate payments on time.

Read our review of the Visa® Petal® 1 Card No Annual Fee.

Summary of the Best Credit Cards for Young People

FAQ

Can I get a credit card if I am under 21?

You must be at least 18 years of age to receive a credit card.

However, the Credit Card Liability and Disclosure Act (CARD) has made it harder to get unsecured credit cards under the age of 21; this is intended to protect young people from predatory credit card practices.

You must show proof of permanent income or assets—in other words, the ability to pay off your debt.

If you cannot do this, you may need to start with a secure card or get a guarantor.

How can I get a credit card if I don’t have a credit history?

You have two options for obtaining a card without a credit history:

- Get a sponsor: Ask a parent, family member, or trusted friend in good standing to become a sponsor. Under such an agreement, the surety agrees to pay your bill if you are unable to do so.

- Protected Credit Cards: They accept lower scores and sometimes don’t even do a credit check. Instead, you make a cash deposit as a line of credit. However, most of them report to the three major credit bureaus and can help you get a loan.

How do secured credit cards work?

A secured credit card is very easy to qualify for regardless of your credit score. They work by requiring a refundable security deposit and then issuing a line of credit equal to the amount of your deposit.

For example, if you deposit $500, you will have a $500 credit limit.

You will then use the secure credit card just like any other credit card. You can make payments to the card, and then you will make payments to your balance. Your payments are reported to three credit bureaus, which can improve your creditworthiness and increase your credit score.

Once your credit score is high enough to qualify for an unsecured card, you can close your secured credit card and get your deposit back.

Here is a list of our favorite secured credit cards.

Do you have any tips for using a credit card for the first time?

Credit cards offer many benefits, including cash back, travel benefits, introductory annual interest rates, and opportunities to improve your credit score.

But if you don’t use them wisely, you can ruin your credit and go into debt.

Here are some tips once you get your card:

- Spend within your means: keep a close eye on your spending. Try not to change your spending habits at all. This will make it less likely to get stuck in credit card debt, allowing you to get your money back and put off spending for a month or longer. Keeping your balance low will also help boost your credit.

- Pay off the balance in full every month: balance sheet costs you a lot of interest.

- Pay off your balance on time: Late payments can result in late fees and damage your credit.

Summary

When you are young, the best card for you is one that is easy to claim and saves you money through rewards and other perks. Conveniently, this article has already collected the best cards for young people, so you should choose the one that works best for you.

But before applying for a card, you must first know your score. By knowing your score, you will be able to choose the best card you are most likely to land on. And if you don’t know your current score, you can use the free Money Under 30 Credit Score Calculator tool.