The content of this page is accurate as of the publication date; however, some offers from our partners may have expired. Browse our list of the best credit cards or use our CardMatch™ tool to find the cards that suit your needs.

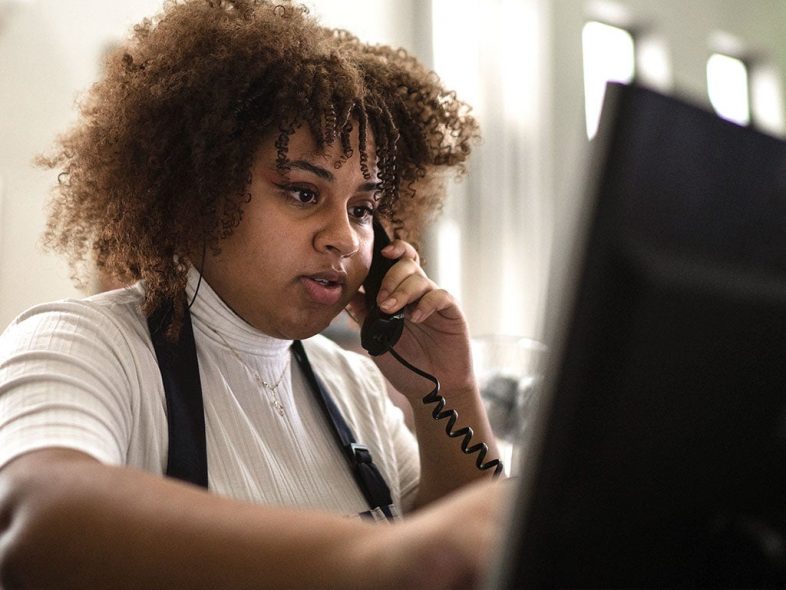

As a merchant, you want to make payments as easy as possible for your customers. If they want to make a purchase with a credit card over the phone, you may be afraid of exposing your business to fraud. So, how can you provide your customers with the best possible experience without putting your business at risk?

Keep reading to learn how to securely accept credit card payments from customers over the phone.

Know the rules of transactions without a card

We recommend that you review the Merchant Guidelines for major credit card issuers such as Mastercard (p. 85) and Visa (p. 519) before accepting a payment by phone.

It is important to read the rules for cardless or “cardless” transactions and make sure that each member of your team is also familiar with the rules for accepting cards and trained to follow them exactly.

Factors such as the rise of online orders have contributed to credit card fraud, but phone orders are also part of the problem. Strict due diligence can help you identify fraudsters before a transaction is processed, so you don’t just become another statistic.

How to accept credit card payments over the phone

After you have gone through the various guidelines for merchants, you will need to work with a virtual terminal, also known as a POS, where you will have a merchant account.

To securely accept credit card payments over the phone, follow these steps:

Step 1. Determine what credit card information you need

All payment processors and POS systems have their own requirements for the collection of credit card data. Typically, you need to obtain the following information from a customer paying by phone so that you can manually enter it into your virtual terminal:

- credit card number

- Shelf life

- Security or CVV code

- Client Name

- Postal address for billing

You may also need to request the type of card (Visa, Mastercard, American Express, etc.) and the customer’s phone number or email address. This information will come in handy when it comes time to issue a receipt.

Step 2. Add a sales order to your system

Add buyer and order information to your system to make sure you track the sale and can calculate taxes and/or shipping charges. This way you can clearly tell your customer what the total cost of their purchase will be before sending the transaction to the virtual terminal.

Step 3: Request Credit Card Information

Now it’s time to collect their credit card information and add it to the virtual terminal so you can send the payment. The virtual terminal will notify you once the transaction has been approved. If the transaction is declined, double-check the customer’s credit card information to make sure you received it correctly over the phone. If the transaction is still not approved after this, the customer will need to use another card to complete the purchase.

Step 4. Complete the order and issue a receipt

Now you can complete the sale. Your virtual system can automatically send a receipt to the customer via email or text message, but if it doesn’t, you’ll have to do it manually. Also keep a copy of the receipt for your records.

Once you understand the correct process for accepting payments securely over the phone, it is also a good idea to educate your employees on how to do this so that anyone can process the transaction when a customer calls and wants to make a purchase.

How much does it cost to accept credit card payments over the phone?

How much it will cost you to accept payments by phone will depend on the virtual terminal you use. You will need to confirm how much each transaction will cost with your particular provider, but here are some examples of how much popular virtual terminals charge per transaction:

- Square: You will pay 3.5% plus $0.15 per transaction.

- Payment Depot: Plans start at $59 per month and include a flat transaction fee ranging from $0.07 to $0.15.

- Clover: Paid plans start at $9.95 per month and 2.3% plus $0.10 per transaction.

bottom line

Making phone purchases through a virtual terminal can help you avoid being scammed. It’s also a good idea to keep a log of any phone transactions and details about the call – and the transaction receipt – in case there are any problems in the future.

Editorial disclaimer

The editorial content on this page is based solely on the objective judgment of our contributors and is not based on advertising. It was not provided or ordered by credit card issuers. However, we may receive compensation when you click on links to our partners’ products.